LOGIC LAB: The Code Library

Access the proprietary frameworks you need to engineer your financial independence, without an expert.

Why You Don't Need an Expert to Own Your Future !

The Fragile Legacy Financial System is built to make finance feel complicated, ensuring you always remain dependent.

We fundamentally disagree.

Our Logic Lab is the core principle of Self-Sustaining System Design. We provide the computational tools and clear blueprints so you can diagnose your own problems, select the right solutions, and perform your own systemic upgrades.

You bring the DISCIPLINE, we supply the LOGIC.

THE FOUNDATIONAL BLUEPRINT

High Rewards, Shaky Foundations

This image powerfully depicts the high risks hidden within unsustainable financial strategies. While significant gains are tempting, without solid foundations, they are constantly on the brink of collapse.

At our Logic Lab, we empower you to diagnose these risks and build your financial systems on stable ground.

This is where we convert our deep system knowledge into Actionable Tools. We help you Recode your consumption patterns and gain intelligent control over your wealth.

The Unconscious Spending System:

Why we buy what we don't need !

Hardware Logic: INPUT (Spending), PROCESSING (Optimization), OUTPUT (Saving).

The Recode Steps:

Turning daily consumption into a Growth Tool

The Ultimate System to Turn Wasted Money into Active Capital

The $5 Coffee Trap is real. Are small daily habits secretly sabotaging your financial future? This engineer-led guide provides a structured, three-step framework to analyze and Recode your core consumption patterns. We don't preach; we teach you how to redirect lost money directly into your long-term wealth strategy. Stop losing money by chance. Start building wealth by design.

The ultimate goal is Intellectual Freedom—the absolute freedom from financial worry, the fear of the future, and the compulsion to live by another's rules.

Stop paying the Hidden Tax of complexity!

The cost of rewriting your financial code is less than one week of the $5 coffee trap.

Get the complete blueprint for only $24.99

Internationally Registered and Published (ISBN). A rigorous framework for absolute financial autonomy

The Logic Library

Financial Design Insights ...

Financial Design Insights ...

Immigrant Resilience

Financial Lessons from Adapting to a New System

Drawing on the experience of building a new life, this article outlines the core Financial Discipline and systemic approaches needed to achieve stability and wealth in the American system.

The Efficiency Gap

Why Passive Investing Needs a Design Strategy

We reveal why simply 'setting and forgetting' isn't enough. Discover the Engineering Principles required to optimize your investment strategy and close the gap between potential and reality.

What is IUL, Really?

An Engineer's Breakdown

A clear, unbiased, and structured analysis of how an IUL functions as a Systemic Financial Tool, not just a policy. Learn the logic, not the sales pitch.

READY TO ENGINEER YOUR WEALTH ?

NASAWAYS System Fundamentalsls

article1

article2

article3

article4

article5

Partner Resources

article1

article2

article3

article4

article5

THE FOUNDATIONAL BLUEPRINTS

Frameworks for System Mastery

Our system engineering approach requires clear diagnostic tools. These frameworks are the computational models we use to cut through the complexity of the legacy financial world. Study them, understand your position, and prepare to design your Anti-fragile future.

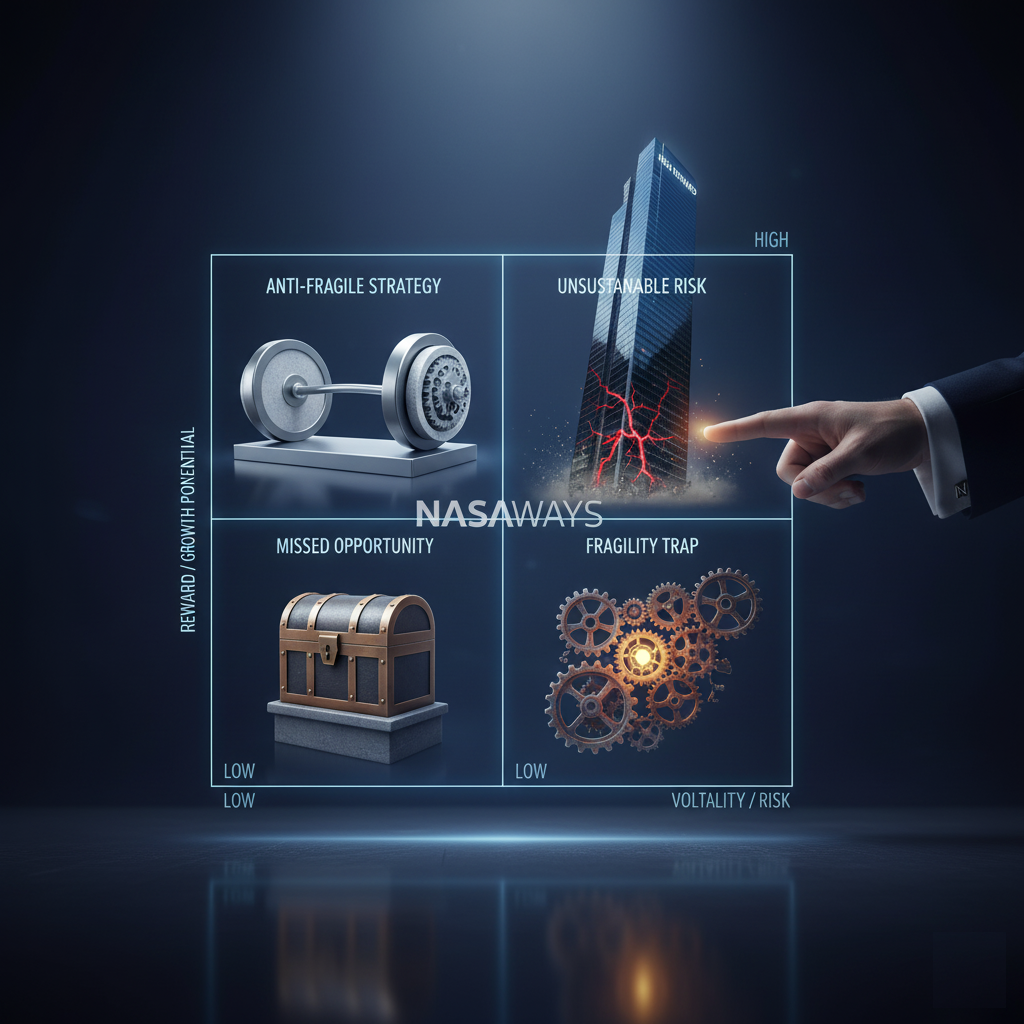

1- The System Position Map

(The 2 x 2 Matrix)

This 2 x 2 matrix serves as your comprehensive map for understanding the current state of your financial operating system. While the horizontal axis charts Volatility/Risk, the vertical axis delineates Reward/Growth Potential. Most individuals, unknowingly, find themselves trapped in the 'Fragility Trap' quadrant, where high risk is tragically coupled with minimal reward. Others reside in the 'Missed Opportunity' quadrant, experiencing safety but no genuine growth. Your trajectory is predetermined by your quadrant.

Our System Engineering objective is to strategically relocate your financial system from these vulnerable zones directly into the 'Anti-fragile Strategy' quadrant: where we've intentionally engineered out unnecessary risk, simultaneously maximizing growth potential to thrive and strengthen from volatility.

This map isn't a theory; it's the diagnostic tool NASAWAYS uses to begin the RECODE. Find your position and commit to the migration.

2- The Fragility Triad

The Three Drivers of System Collapse

Fragility is not an accident; it is the predictable outcome of three overlapping pressures. The Triad isolates the core systemic weaknesses that create Awkward Financial Code:

1- Over-Leverage (excessive debt)

2- Excessive Complexity (unnecessary products and confusion)

3- Zero Margin of Error (the inability to absorb even small shocks)

By identifying where these three forces are tightening around your system, you gain the clarity needed to apply structural engineering. This is the critical first phase of the NASAWAYS Method: Diagnosis. You can only fix what you can precisely define. Stop managing the symptoms of the Awkward Code; use this model to define the root vulnerability and prepare for its complete replacement.

3- The Barbell Model

Strategic Separation for Anti-fragile Growth

The key to Anti-fragile Architecture is recognizing that the middle ground is the most dangerous zone. The Barbell Model is the logical, engineered alternative to conventional moderation. It demands a rigorous separation of your capital into two non-negotiable extremes:

90% is allocated to Extreme Safety—assets designed to provide principal protection (such as Indexed Life Solutions that guarantee against market loss).

The remaining 10% is allocated to Extreme Opportunity—highly aggressive, asymmetric growth bets. This strategic void in the 'moderate risk' middle is where the system gains its resilience and growth. When shocks occur, the 90% foundation remains untouched, allowing the high-growth 10% to recover and amplify gains.

Use this model to stop playing the market and start engineering outcomes.

T O P

SYSTEM INFRASTRUCTURE & AUDITING

The audited platform where the blueprints are implemented

A great blueprint is useless without a reliable construction platform. Our intellectual models are powered by the robust, audited infrastructure of the financial industry’s most respected partners. This section provides the essential knowledge resources to understand the foundation beneath the NASAWAYS architecture.

1- Partner Resources

Access to National Licensing & Product Infrastructurs

The Anti-fragile Strategy requires assets that are guaranteed against loss (the 90% foundation of the Barbell Model). We achieve this by leveraging the audited solutions and institutional stability provided by our strategic partners. These firms—all highly rated and compliant— provide the financial strength and regulatory compliance necessary to ensure our blueprints are implemented with the highest degree of security. Access their public resources below to understand the power of your foundational assets.

Links:

Understanding the Mission and Vision of Our National Licensing Platform Understanding Indexed Universal Life (IUL) as a Foundational Asset

Financial Strength Ratings and Overview of Top-Tier Carriers Overview of a Leading Fortune 100 Financial Enterprise

Official Financial Strength Ratings of Our Core Carriers Long-term Savings and Retirement Products from Institutional Providers

2- NASAWAYS System Fundamentals

Diagnosing the Code

Before the RECODE can begin, you must master the concepts of financial entropy and systemic leakage. These short, focused lessons—presented by our System Architects—will give you the language and precision required to spot the Awkward Financial Code that is draining your energy and resources.

Precision is the key to engineering.

Resources:

Framework/system manual: The $5 Coffee Trap Explained: Entropy in Personal Finance